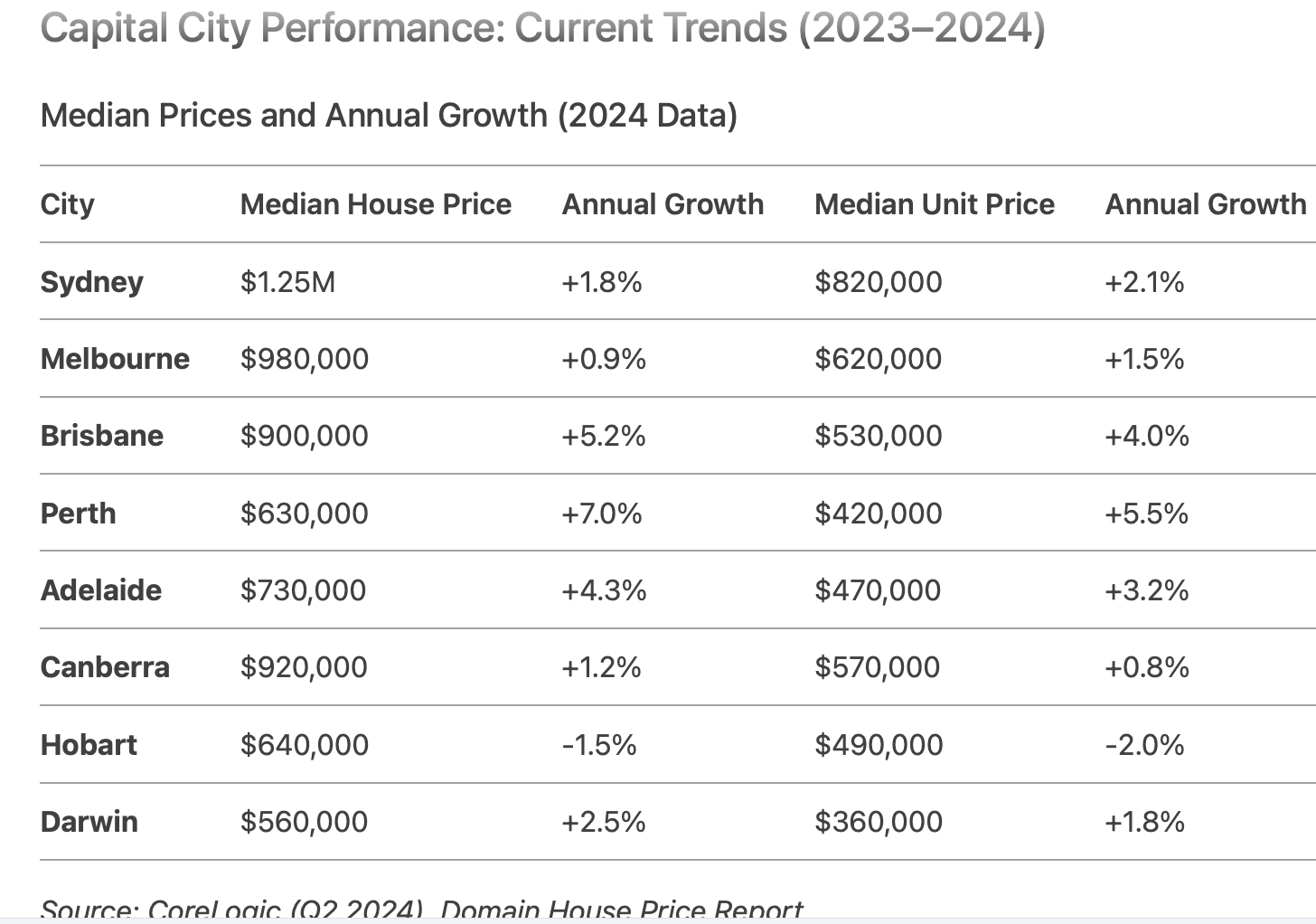

The Australian property market remains a dynamic landscape shaped by economic forces, demographic shifts, and policy changes. As we look ahead to 2025, capital cities will continue to dominate headlines, with diverging trends driven by affordability, infrastructure investments, and population growth. In this analysis, we synthesize data from CoreLogic, ABS (Australian Bureau of Statistics), SQM Research, Domain, and REA Group to provide a reliable forecast for 2025.

Key Drivers of the 2025 Property Market

Interest Rates: The Reserve Bank of Australia (RBA) is expected to hold or marginally cut rates in 2025, easing borrowing costs and stimulating buyer activity.

Population Growth: Immigration is projected to stabilize at pre-pandemic levels (~200,000 annually), with Sydney, Melbourne, and Brisbane absorbing the bulk of newcomers.

Housing Supply: Construction bottlenecks persist, particularly in Sydney and Melbourne, with only 160,000 new dwellings forecasted against demand for 240,000.

Infrastructure Projects: Major developments (e.g., Brisbane’s 2032 Olympics, Sydney Metro) will boost demand in connected suburbs.

Affordability Pressures: First-home buyers are pivoting to units and outer suburbs as house prices outpace wage growth (3.1% vs. 4.5% annual price growth).

2025 Predictions for Capital Cities

1. Sydney

Prediction: 3–5% house price growth, 2–4% unit growth.

Why: Rate cuts, infrastructure upgrades (e.g., Western Sydney Airport), and persistent undersupply. Premium suburbs like Parramatta and Liverpool will outperform.

Risk: Affordability ceilings could limit gains in luxury markets.

2. Melbourne

Prediction: 2–4% house growth, 1–3% unit growth.

Why: Revival in CBD unit demand as international students return (projected 15% YoY increase). Suburban hubs like Geelong and Melton benefit from remote work trends.

Risk: Oversupply of inner-city apartments may dampen unit prices.

3. Brisbane

Prediction: 6–8% house growth, 5–7% unit growth.

Why: Olympic-driven infrastructure (e.g., Cross River Rail), interstate migration (+25,000 annually), and relative affordability. Hotspots: Logan, Ipswich.

Risk: Construction delays could inflate prices further.

4. Perth

Prediction: 8–10% house growth, 6–8% unit growth.

Why: Surging mining sector investment (iron ore demand), lowest vacancy rate (0.6%), and 20% cheaper than Sydney. Focus: Midland, Ellenbrook.

Risk: Economic reliance on mining exposes the market to commodity cycles.

5. Adelaide

Prediction: 4–6% house growth, 3–5% unit growth.

Why: Lifestyle appeal, affordability (40% cheaper than Sydney), and defense sector jobs. Growth corridors: Mount Barker, Gawler.

Risk: Limited land supply may stall long-term growth.

6. Canberra

Prediction: 2–3% house growth, 1–2% unit growth.

Why: Stable public sector employment and low unemployment (3.2%). Demand shifts to Gungahlin and Molonglo Valley.

Risk: High stamp duty costs deter investors.

7. Hobart

Prediction: -1% to +1% house growth, -2% to 0% unit growth.

Why: Post-pandemic slowdown, affordability challenges (median income-to-price ratio: 8.1x).

Opportunity: Tourism rebound could revive short-term rental demand.

8. Darwin

Prediction: 3–5% house growth, 2–4% unit growth.

Why: Defence and energy projects (e.g., Middle Arm Sustainable Development Precinct).

Risk: Small market size amplifies volatility.

Regional Insights

Interstate Migration: Queensland remains the top destination, with 35% of migrants from NSW and Victoria (ABS).

Investor Activity: Rising in Perth (25% of buyers) and Brisbane (20%) due to high rental yields (5.8% and 5.2%, respectively).

First-Home Buyers: Concentrated in Adelaide and Darwin, where grants and lower deposits ease entry.

Conclusion

Australia’s capital cities will see a tale of two markets in 2025. Brisbane and Perth are poised for double-digit growth, fueled by infrastructure, migration, and resource sector strength. Sydney and Melbourne will rebound moderately as interest rates ease, while Hobart faces stagnation. Investors should prioritize markets with robust population growth and infrastructure pipelines, while first-home buyers may find value in Adelaide and Darwin.

As always, macroeconomic shocks—such as global recessions or policy shifts—could alter these trajectories. Consult property professionals and diversify your strategy to mitigate risks.

We continue to take a purely data drive approach to real estate investing, get 5 properties that

Data Sources: CoreLogic (June 2024), ABS Population Data (2024), SQM Research Vacancy Rates, Domain Price Forecasts.

Disclaimer: Predictions are indicative and not financial advice. Market conditions may change rapidly